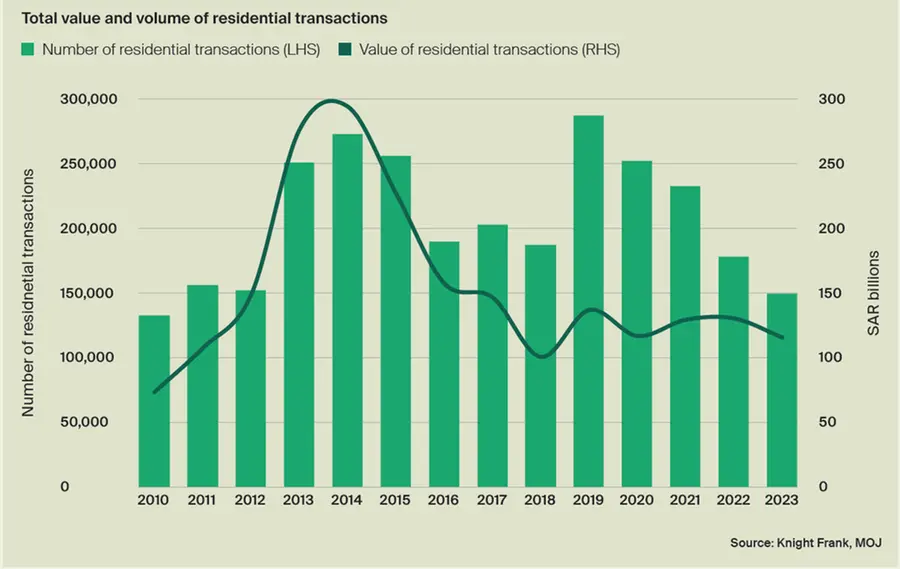

- Just under 150,000 sales between January and November 2023

Saudi Residential transactions decline 16% during 2023

Riyadh|Jeddah: Residential transactions, which accounted for 58.7% of all real estate deals by total value, registered a -16% fall in the number of deals to just under 150,000 sales between January and November 2023, according to global property consultancy Knight Frank’s Winter 2023/24 Saudi Residential Market Review report.

The total number of real estate transaction volumes across all asset classes in Saudi Arabia slipped by -17% in 2023 to just over 177,000, while the total value of all deals declined by -9% to SAR 197.7bn, Knight Frank says.

Faisal Durrani, Partner – Head of Research, MENA, explained: “The residential market has experienced phenomenal price growth over the last two to three years, with prices in Riyadh, for instance, continuing to climb into record high territory. Unsurprisingly, the high home values have contributed to growing affordability issues, which have been further exacerbated by the rising cost of borrowing. Indeed, interest rates have jumped from around 0.8% in January 2021 to 6% at the end of last year.

“A further complication in the housing market is the structural shift in demand. Younger Saudi’s are delaying home ownership not only due to affordability considerations, but intra-Saudi migrants are preferentially seeking to rent, rather than own. The impetus to introduce build-to-rent stock, managed to an international standard remains a tremendous market opportunity”.

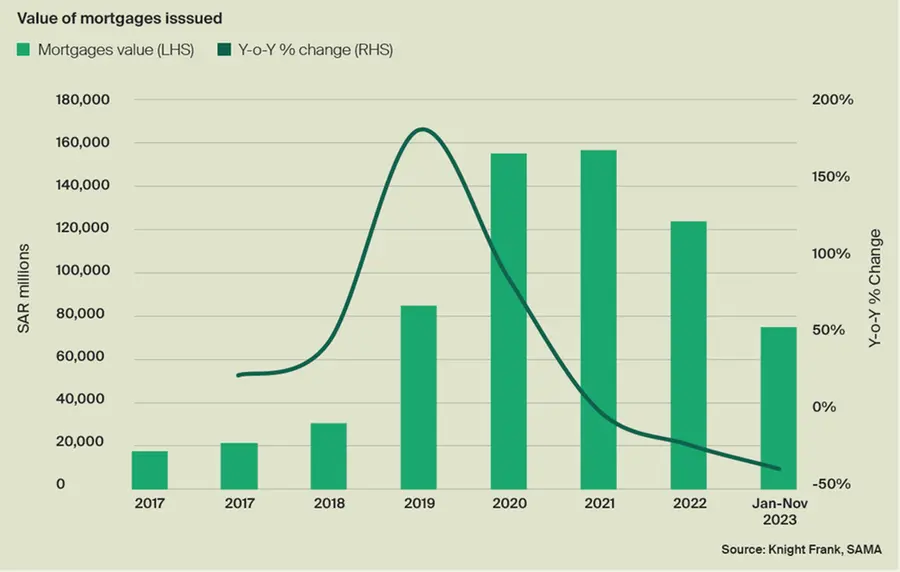

Knight Frank says the total number of mortgages issued between January-November 2023 fell by -35%, compared to a decline of -22% over the same period last year.

Similarly, the total value of mortgages issued declined by -36% to SAR 74.2bn during the same period as higher interest rates and prices move potential buyers into a longer holding pattern while they amass ever increasing deposits.

Prices in Riyadh buck national trend

Unlike like the rest of the Kingdom, home values in Riyadh have continued to climb. Apartment prices are up 4.5% compared to this time last year, while villa values have increased by 0.5%. Transaction volumes in the capital rose by 7% last year, compared to a -21% fall in Jeddah and a -12% decline in the Dammam Metropolitan Area.

Talal Raqaban, Partner – Valuation, PPP and Deal Advisory, Saudi Arabia, said: “Riyadh sits at the centre of the Kingdom’s economic activity. It’s where job creation rates are the highest, in large part driven by Program HQ which has seen 200 companies commit to establishing their regional headquarters in the Kingdom.

“Even with 241,000 homes due to be delivered by 2030, the projected doubling of the population over this period to 16 million will still result in a housing shortfall of 1.5 million units”.

Jeddah transaction levels decline

Knight Frank’s analysis also reveals a decline in deal activity in Jeddah’s residential market. The number of residential transactions registered across Jeddah saw a double-digit decline of -21%, dropping from 23,990 deals in 2022 to 18,897 in 2023. In addition, the value of transactions declined at a rate of -26% during the same period to end 2023 at SAR 20.9bn.

Average villa prices in Jeddah fell marginally by -2.5% during 2023 to SAR 5,085 psm. Q4 2023 alone registered a decrease of 1% in villa values.

Yazeed Hijazi, Associate Partner – Co Head of Real Estate Strategy & Consulting, based in Knight Frank’s Jeddah office, added: “The decreasing number of transactions is affecting the value of transactions throughout the kingdom, with the main reason being an increase in interest rates, which is leading to affordability issues.

“The government is working on ways to revive demand in Jeddah through new large-scale real estate and infrastructure projects, which are expected to boost job creation rates and housing demand levels in the medium to long term”.

About Knight Frank:

Knight Frank LLP is the leading independent global property consultancy. Headquartered in London, the Knight Frank network has 487 offices across 53 territories and more than 20,000 people The Group advises clients ranging from individual owners and buyers to major developers, investors, and corporate tenants. For further information about the Firm, please visit www.knightfrank.com.

In the MENA region, we have strategically positioned offices in key countries such as the United Arab Emirates, Saudi Arabia, Bahrain, Qatar, and Egypt. For the past 13 years, we have been offering integrated residential and commercial real estate services, including transactional support, consultancy, and management.

Understanding the unique intricacies of local markets is at the core of what we do, we blend this understanding with our global resources to provide you with tailored solutions that meet your specific needs. At Knight Frank, excellence, innovation, and a genuine focus on our clients drive everything we do. We are not just consultants; we are trusted partners in property ready to support you on your real estate journey, no matter the scale of your endeavour.

For all Media and PR inquiries, please contact:

Roksar Kamal, Press Manager

Roksar.kamal@me.knightfrank.com

Let’s connect socially – find us on LinkedIn, Instagram, and Twitter.

For more information and to explore how we can be your partners in property, please visit our website at https://www.knightfrank.com.sa/

Send us your press releases to pressrelease.zawya@lseg.com

© Press Release 2024