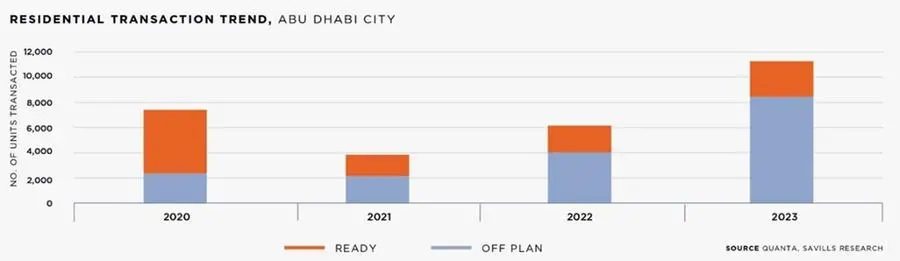

- 2023 was among the best years for the residential sector in Abu Dhabi with 11,200 units sold across the city.

- Under-construction properties accounted for 75% of transactions in 2023.

- More than 8,000 units were launched to meet the growing demand.

Abu Dhabi residential sector achieves record growth in 2023: Sales surge by 83% year-on-year

Abu Dhabi’s residential sector has witnessed one of the best years on record, where a total of 11,200 units were sold across the capital, up 83% y-o-y. The increase in demand for residences has been driven by several positive initiatives and announcements by the government, a thriving economy, and new project launches, Savills latest research on the emirate’s residential sector showed.

Abu Dhabi has also benefited from a rise in the number of expats and digital nomads, as reflected in the Savills Executive Nomad Index, where the city made a new entry this year to claim 4th place.

Stephen Forbes, Head of Savills Abu Dhabi, said, “The growing demand has led to a spike in new project launches, with more than 8,000 units launched. Market transparency also improved over the course of the year, making it more appealing to a broader range of investors and end-users beyond the traditional investor segment. In 2023, the market had benefited from an increase in investments by foreign nationals and sustained demand levels from the Emirati population.”

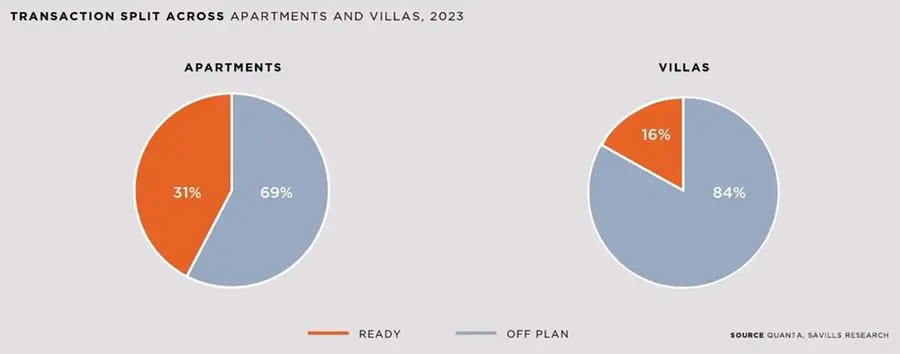

A steady rise in demand for high-end villas and townhouses was observed, Savills noted. The segment emerged as one of the most popular in 2023, a trend mirrored in other emirates. In 2023, 4,800 villa and townhouse units were sold, accounting for 43% of total sales. Off-plan transactions accounted for approximately 84% of all villa and townhouse transactions. Demand was highest for projects on Saadiyat Island, Yas Island, and Al Reem Island, indicating a preference for these waterfront locations among end-users and investors.

Among other new projects, the Abu Dhabi Housing Authority (ADHA) has announced the opening of 1,700 units in Balghaiylam, a new residential development located north-east of Yas Island.

Ali Ishaq, Head of Residential Agency at Savills Abu Dhabi, added, “Villa prices have appreciated across the emirate, with some locations recording higher gains than others. The average capital value for villas in the city grew by 6% y-o-y, to reach 11,800 AED/sq m, however some locations like Saadiyat Island and Yas Island recorded capital values as high as 16,000 AED/sq m.”

Apartments took up a larger share of the sales pie, comprising 57% of total transactions. Off-plan apartments accounted for 69% of the demand. Due to the strong demand, nearly 3,400 units were launched in the year, with 51% located across the Yas and Saadiyat Islands. In recent years, Yas Island has gained popularity among residents due to the introduction of new family entertainment options.

Saadiyat Island has witnessed the launch of 700 units by Aldar Properties, as well as projects like Nobu Residence, Manarat Living, and The Source. Tiger Properties’ Renad Tower project added only 256 units to Al Reem Island, compared to Yas Island and Saadiyat, which saw more new project launches. 2023 saw several notable project launches, including Aldar Properties at Al Shamhka, Bloom Properties’ Casares at Bloom Living, Marsa Al Jubail, Jubail Terraces at Jubail Island, and Reportage Real Estate’s Royal Park at Masdar City.

The capital value of apartments continued to rise, increasing by an average of 6% year on year, while the average capital value for apartments in the city is at 14,800 AED/sqm, with some areas experiencing up to 18% y-o-y growth, and apartment rental values remained stable, with less than 1% growth y-o-y.

“The non-oil sectors have seen significant expansion over the past two years, remained healthy, and are well positioned to grow over the next twelve months, affecting the real estate sector positively,” continued Swapnil Pillai, Associate Director of Research at Savills Middle East. The industry has also profited from the government’s recent decision to remove the minimum down payment needed for applicants to qualify for a Golden Visa, since it will further encourage more people to become long-term city residents and encourage buyers to invest in real estate.

About Savills Middle East:

Savills plc is a global real estate services provider listed on the London Stock Exchange. With a presence in the Middle East for over 40 years, Savills offers an extensive range of specialist advisory, management and transactional services across the United Arab Emirates, Oman, Bahrain, Egypt, and Saudi Arabia. Expertise includes property management, residential and commercial agency services, property and business assets valuation, and investment and development advisory. Originally founded in the UK in 1855, Savills has an international network of over 700 offices and associates employing over 40,000 people across the Americas, UK, Europe, Asia Pacific, Africa, and the Middle East.

For further information, please contact:

Savills press office:

amjad.mkayed@savills.me

siddhi.sainani@savills.me

www.savills.me

To get a copy of the detailed report, please visit: https://pdf.euro.savills.co.uk/uae/abu-dhabi/abu-dhabi-residential-market-2023.pdf

Send us your press releases to pressrelease.zawya@lseg.com

© Press Release 2024