Value of Saudi Arabia’s real estate and infrastructure projects top $1.25tn

The value of real estate and infrastructure projects announced since Saudi Arabia rolled out its National Transformation Plan in 2016 has crossed $1.25 trillion, agency Knight Frank has said.

With the execution deadline of the end of this decade fast approaching, the kingdom has commissioned projects worth $250 billion so far since the launch of its Vision 2030 economic and social diversification programme, the global real estate consultancy said in its annual Saudi Giga Projects report.

Saudi Arabia, the Arab world’s biggest economy and Opec’s top oil producer, is aiming to cut its dependence on the sale of hydrocarbons.

Riyadh’s overarching Vision 2030 agenda seeks to further develop the kingdom’s industrial base, broaden the country’s infrastructure and advance sectors including real estate, health and education to create more jobs for its rapidly expanding population.

The development of the tourism and hospitality sector is one of the central planks of Vision 2030. Saudi Arabia’s sovereign investment arm, the Public Investment Fund, is backing several projects in the kingdom including the $500 billion futuristic city Neom, and multi-billion-dollar developments on the Red Sea coast, as well as in Riyadh.

“Arguably one of, if not the most, expansive real estate development programmes ever seen in the world is gathering pace in Saudi Arabia as the 2030 deadline nears to realise Vision 2030,” Faisal Durrani, partner and head of Mena research, said.

Saudi Arabia, which was the fastest-growing major economy last year, aims to receive 100 million tourists by 2030 and is investing heavily in expanding its retail and hospitality offerings.

Knight Frank said the value of real estate and infrastructure projects across the western half of the country has climbed to $687 billion.

“The western half of the kingdom contains the highest concentration of headline-grabbing projects in the country, including of course Neom,” Harmen de Jong, partner and head of strategy, Saudi Arabia, at Knight Frank said.

:quality(70)/cloudfront-eu-central-1.images.arcpublishing.com/thenational/HYCWKAEEDFDL3JRVVNELW2XCDM.jpg)

:quality(70)/cloudfront-eu-central-1.images.arcpublishing.com/thenational/CWATIAIYOZCVDO3KI2KGBLPWN4.jpg)

:quality(70)/cloudfront-eu-central-1.images.arcpublishing.com/thenational/MUYZJRPKHIJCGTUEPRIKGPINWM.jpg)

:quality(70)/cloudfront-eu-central-1.images.arcpublishing.com/thenational/S6CJWDUS3X446JXHNOUY4UQVVA.jpg)

:quality(70)/cloudfront-eu-central-1.images.arcpublishing.com/thenational/2COYU5WPROJV26PVVD25BBSV4U.jpg)

:quality(70)/cloudfront-eu-central-1.images.arcpublishing.com/thenational/EKGWXL4WXVE27HNCPEG6APMTPE.jpg)

:quality(70)/cloudfront-eu-central-1.images.arcpublishing.com/thenational/WKPLFQLIFZE3FOWY6K3PRFWASA.jpeg)

:quality(70)/cloudfront-eu-central-1.images.arcpublishing.com/thenational/FKSG4Q5MD7UCN2L2OZTNK3ONLE.jpg)

:quality(70)/cloudfront-eu-central-1.images.arcpublishing.com/thenational/372FMK7R4434Z5Y6SUCTWY3HEI.jpg)

:quality(70)/cloudfront-eu-central-1.images.arcpublishing.com/thenational/XCVPI7342RC5DNQCI4LKDBOVZA.JPG)

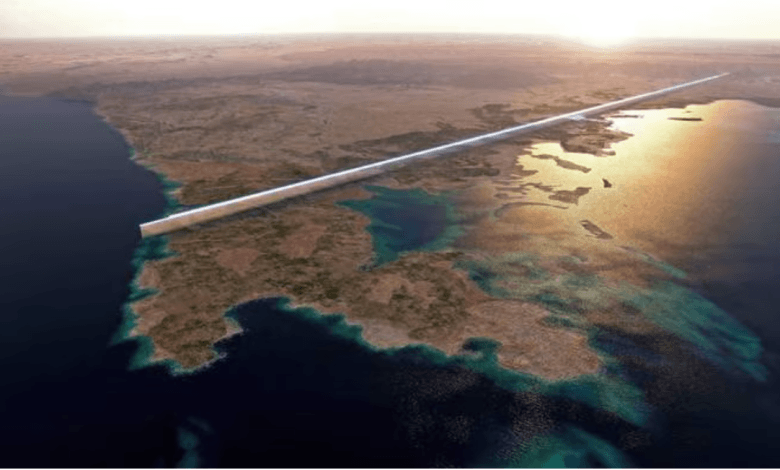

The Line is one of 10 districts in Saudi Arabia’s $500 billion Neom megacity. Photo: Neom

In the last year, authorities announced various sub-components in Neom, including Trojena, the host location for the 2030 Asian Games, as well as Sindalah, a luxury island that will be the first of Neom’s projects to materialise.

“Neom overall is also progressing rapidly, with $70 billion of projects now awarded, 45 per cent of which has been completed,” he said.

The transformation is “clearly visible across the entire urban landscape”, as the planned giga projects are set to vastly expand the residential, office, retail, hospitality and industrial offerings to accommodate the projected population growth to 50 million by 2030, the report said.

Riyadh, in particular, is a hive of development activity and currently accounts for 18 per cent of all real estate projects under way, totalling about $229 billion, Knight Frank said.

The volume of residential units planned has climbed 30 per cent over the past 12 months to 660,000 units, which is “welcome news” for prospective homeowners.

A rise in the values of residential properties in recent quarters led to a nationwide decline in the volume of homes being sold in the kingdom, according to the report.

“Affordability is still a key hurdle for many buyers and so price points for the new inventory will be critical to reigniting domestic demand,” Mr Durrani said.

In the commercial market, 5.3 million square metres of retail space is now planned, with a further 289,000 hotel rooms that “will go some way to supporting Saudi Arabia’s goal of hosting 100 million visitors by 2030”, he said.

The office real estate pipeline in the kingdom is also steadily growing, reaching six million square metres.

“The swelling of the office pipeline is set against a backdrop of a severe shortage of prime Grade-A space in cities such as Riyadh, which stands in stark contrast to other global centres where occupancy levels still trail pre-pandemic levels,” Mr Durrani said.