Unlocking Africa’s economic resurgence: Can The Middle East’s Investments hold the key?

NAIROBI, Kenya: Amidst the complex economic landscape of African nations and the challenges they face, the Middle East-Africa partnership has emerged as a beacon of hope, potentially offering a much-needed boost to underserved communities.

With Chinese investments taking a backseat in the continent, the Middle East’s growing involvement in Africa’s development has become a lifeline, addressing critical economic and infrastructure needs.

Sub-Saharan Africa is grappling with a rising debt burden, reaching around 60 percent of gross domestic product — a level last seen two decades ago.

This is causing a shift towards higher-cost private sources, escalating debt service costs and rollover risks.

Against this backdrop of economic turmoil, the Middle East-Africa partnership is taking center stage. As China retracts its investment commitment, countries within the Gulf Cooperation Council – including Saudi Arabia, the UAE, and Qatar – are stepping in to fill the void. GCC investment has surged, reaching $8.3 billion in 2022, a promising sign of the partnership’s potential.

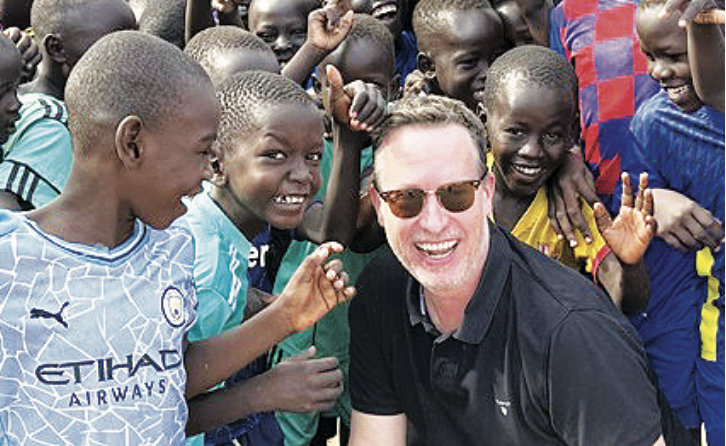

“This trend signifies the growing prominence of these countries as key partners in Africa’s development journey,” Ryan O’Grady, the CEO of investment firm KI Africa who regularly commutes between Dubai and East Africa, told Arab News. “The connection between the Middle East and Africa, nurtured over decades, continues to flourish, signaling the strengthening of trade relationships,” he added.

Experts say that the GCC’s interest in Africa’s growth is fueled by robust GDP figures within the region and an abundance of available capital. Traditional ties between the GCC and North Africa have been strong due to cultural and linguistic affinities, but the focus is shifting towards sub-Saharan Africa, presenting new avenues for collaboration. UAE-based Mashreq Bank is leading the way, making investments across 14 African countries, while GCC funders are seeking partnerships with local lenders to bolster infrastructure development.

The GCC’s diversification away from natural resources has paved the way for substantial investment in various sectors, including infrastructure, telecoms, and food security. Notably, Qatar’s IAS International plans to invest $1.6 billion in development projects in the Central African Republic, while Saudi Arabia, the UAE, Qatar, Bahrain, and Kuwait are acquiring agricultural land in Africa, driven by food security concerns.

This is why the Middle East-Africa corridor not only makes logistical sense but also aligns with the policy objectives of both regions. As African nations seek substantial inbound investment, the Middle East possesses ample capital and a sophisticated Islamic finance market that can effectively cater to the needs of Africa’s growing population.

According to CNBC, the collective assets under management by the top 10 sovereign wealth funds in the Gulf region stand at nearly $4 trillion. To put this figure into perspective, it surpasses the GDP of the UK.

“As the African market’s scale is notably smaller, the substantial size difference between banks, market scope, and deal flow in these regions poses challenges for cross-regional collaboration,” O’Grady said, emphasizing also the critical issue of financial inclusion in Africa.

“Only 37 percent of women and 48 percent of men in Africa have access to formal financial services,” he added. This inequality underscores the need for innovative solutions to bridge the gap, especially for traditionally marginalized populations.

Drawing attention to the progress made in Dubai, O’Grady noted the growing emphasis on fintech and forward-thinking solutions. The intention is to dismantle traditional barriers within the financial sector and create more effective, cost-efficient, and outreach-oriented approaches. This strategic shift in focus aligns with the GCC’s strong performance in the service and banking sectors, as well as its success in trade finance.

“By combining the strengths of the GCC’s financial sector with the emerging fintech landscape, the region can overcome the inherent disconnects when operating in Africa,” O’Grady commented, predicting that these advancements, coupled with innovative delivery methodologies, will enable a more affordable and extensive reach to the African consumer base.

This, in turn, could lead to greater financial inclusion and increased access to formal financial services for a broader segment of the population.

“Risk factors are inherent to investing everywhere,” he stated, pointing out that risks can be mitigated through expertise, strategic structuring, and emerging tools. In his view, noteworthy steps, such as currency pairing for trade settlement and insurance products, reflect the concerted effort to reduce transaction costs, enhance efficiency, and facilitate smoother business operations.

Despite some advancements, there remain several challenges that hinder growth.

“Beneath Africa’s potential lies an infrastructure deficit that can disrupt business operations,” Subomi Plumptre, a global entrepreneur, originally from Nigeria, told Arab News.

“Insufficient transportation networks, erratic energy supplies, and communication barriers can inflate costs and test investors’ patience,” she added.

The World Bank estimates an annual reduction in economic growth by as much as 2 percent, with productivity enduring a staggering 40 percent decrease as a result of substandard infrastructure.

“The unfavorable state of roads, railroads, and ports further escalates costs within intra-African trade, thereby impeding the crucial process of regional economic integration,” Plumptre said.

African ports are 50 percent more expensive than their global counterparts due to poorly equipped and badly operated facilities. Similarly, rail infrastructure is concentrated in a few countries with higher per capita income, leaving vast regions underserved.

While challenges persist, Plumptre highlighted some positive trends. Notably, the telecom sector has witnessed remarkable growth, making Africa the fastest-growing and second-largest mobile phone market globally.

The introduction of innovative financing instruments and foreign investments in the region, coupled with initiatives to improve transparency and governance, has also contributed to positive developments.

However, navigating Africa’s political landscape can be like piecing together a puzzle with constantly shifting pieces.

Political transitions, policy changes, and regulatory uncertainties can catch investors off guard, prompting the need for adaptable strategies. Unrest in various pockets of the region keeps political stability at the forefront of investors’ minds, influencing their risk assessments and investment decisions.

“It’s crucial to recognize that investment plans and policies designed towards ‘Africa’ consider the differences, ensuring that initiatives are tailored to meet each nation’s unique requirements,” Metassebia Hailu Zeleke, a business lawyer from Ethiopia, told Arab News.

Against this background, the UAE and Kenya are negotiating a comprehensive economic partnership agreement to enhance bilateral trade. Private companies are also seizing the opportunities, with African businesses establishing bases in the UAE to engage with global markets.

China’s investments have come with mixed results and reactions, particularly concerning issues around Africa’s growing indebtedness and Beijing’s control of resources in countries on the continent.

Increasingly citizens are demanding, and governments are shopping for, alternatives to Chinese funding. GCC countries can make a difference, and avoid reputational risks.

The emphasis on building off of natural relationships is a pivotal concept, because rather than forging entirely new paths, the GCC-Africa partnership leverages historical ties and geographical proximity. This approach recognizes the value of familiarity, mutual interests, and established networks, creating a foundation for sustained collaboration.

Plumptre also highlighted the importance of strengthening governance and transparency within the Middle East-Africa investment corridor. Successful navigation of partnership hinges on a threefold challenge: engaging local populations, navigating intricate land ownership concerns, and adeptly managing local conflicts.

She emphasized the need for private sector-led initiatives and public sector engagements to foster understanding, dialogue, and transparency between investors and entrepreneurs from both regions.

“Diverse socio-economic backgrounds and historical contexts envelop Africa’s communities,” Zeleka, the Ethiopian lawyer, said, and this necessitates open dialogues and collaboration with stakeholders for investments to truly align with local needs.