Existing market continues to scale in Abu Dhabi with a YOY increase of approximately 43% in volume

Press Release

- Existing market continues to scale in Abu Dhabi with a YOY increase of approximately 43% in volume, with 1,067 transactions touching AED 2.37 billion, despite an overall decline in sales transactions in comparison to Q3 last year

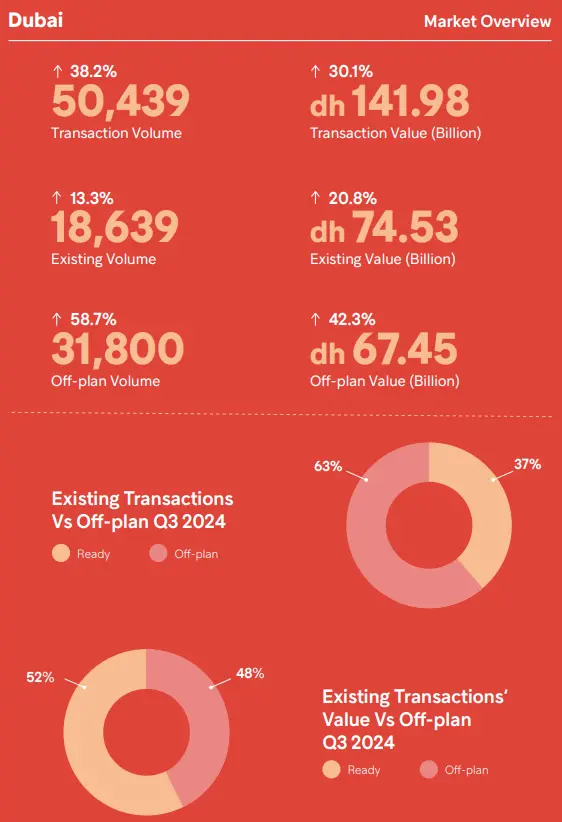

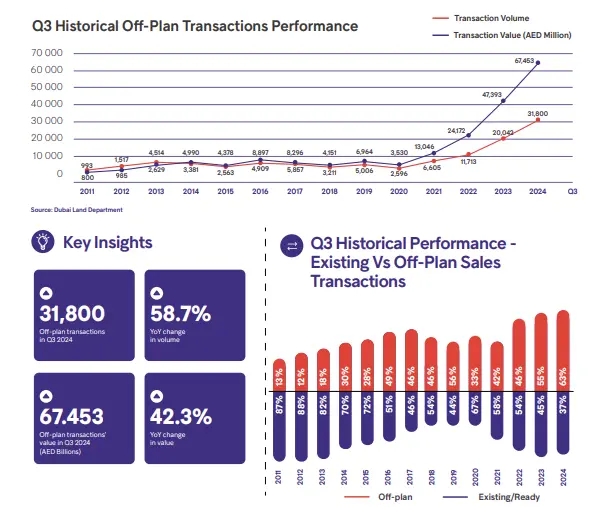

- Dubai demonstrates off-plan growth with a YOY volume spike of roughly 58.7%, with 31,800 transactions, reaching AED 67.45 billion.

Dubai, United Arab Emirates: Property Finder – MENA’s leading property portal has revealed key data from its Market Watch digest report for Q3 2024, unveiling the latest real estate insights to look out for.

Dubai surpassed previous records, marking the highest volume of quarterly transactions with a total of 50,439, and values touching AED 142 billion. Q3 2024 outperformed the market peak from Q2 2024 by 15% in volume and 14.5% in value, largely led by off-plan transactions, which accounted for 63% of the total transactions, compared to 55% in Q3 2023.

Moreover, Abu Dhabi’s residential real estate momentum contributed to 1,813 transactions in total, touching AED 4.92 billion, accounting for 63% of the total transaction volume (residential, commercial and others) and 56% of the transaction value.

Key insights included:

Off-plan Market:

- Dubai:

- Off-plan sales in the Emirate demonstrated increased demand, with a year-on-year volume growth of roughly 58.7%, touching 31,800 transactions.

- This marked the highest volume for a quarter ever recorded. In terms of values, there was a year-on-year surge of around 42.3%, amounting to AED 67.45 billion, compared to AED 47.39 billion in Q3 2023.

- The market also surpassed its 2009 peak, with 31,800 transactions compared to 26,629 in 2009, reflecting a 19.4% increase.

- Abu Dhabi:

- The off-plan market registered approximately 746 transactions, accounting for 41% of the total in Q3 2024.

- Values reached AED 2.56 billion, contributing to 52% of the total for the quarter.

Existing/Ready Property Market:

- Dubai:

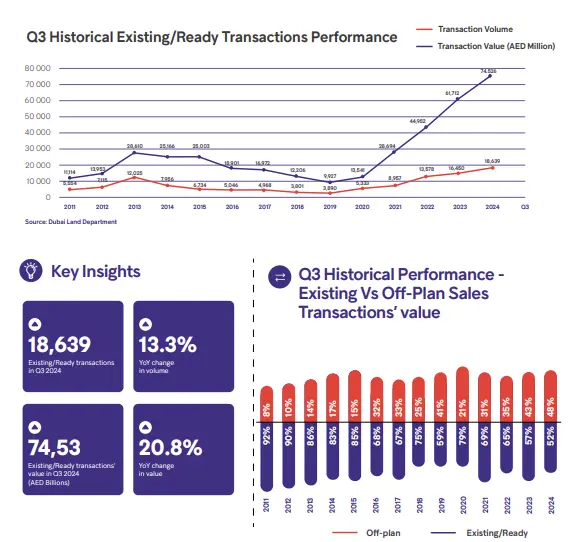

- Existing property related transactions showed a YoY increase of around 13.3% in volume, with nearly 18,639 transactions compared to 16,450 during the same quarter last year.

- This accounted for 37% of the total transactions in Q3 2024. The market also experienced a notable volume growth of 7.9% from Q2 2024.

- The value of these transactions increased by 20.8% YoY, touching AED 74.53 billion, compared to AED 61.7 billion in Q3 2023.

- This contributed to 52% of the total sales transaction values, compared to 57% in Q3 2023.

- Abu Dhabi:

- 1,067 transactions in Q3 2024 represented around 59% of total transactions, compared to 747 in Q3 2023, contributing to 24% of the total.

- This reflected a notable growth of 42.8% YoY, marking the highest transaction volume and value recorded in the last eight quarters.

- The value of existing/ready transactions in Q3 2024 reached AED 2.37 billion, contributing 48% of the total sales transaction value, compared to 15% in Q3 2023.

- This represented a 44.8% increase compared to AED 1.6 billion in Q3 2023, despite a decrease in year on year overall transactions

“Q3 2024 achieved significant milestones for Dubai’s real estate market, reflecting a robust surge in activity and a clear shift towards owner-occupancy. This transformative trend underscores the growing appeal of off-plan properties, which are increasingly resonating with buyers. We’ve observed an uptick in buy-to-live transactions, evidenced by the increase in mortgage processing through our Mortgage Finder advisory service. We also welcomed The Dubai Real Estate Strategy 2033 this quarter, aligning seamlessly with our own vision, reinforcing the importance of strategic investments and cross-industry collaboration to enhance resilience within the sector. In this vein, we further recognise the positive momentum in Abu Dhabi’s market, which further enriches the regional landscape. The Abu Dhabi Real Estate Centre’s newly launched Rental Index also promises greater transparency for tenants and landlords, supporting a stable growth for property in the Emirate. At Property Finder, we remain dedicated to empowering home-seekers with the insights and tools necessary to navigate this evolving landscape and make informed decisions, collaboratively elevating the real estate ecosystem.” Cherif Sleiman, Chief Revenue Officer, Property Finder.

The detailed Property Finder Market Watch Report for Q3 2024 is available for download here.

Disclaimer

Market Watch Digest (MWD) serves as a streamlined version of the comprehensive Market Watch report, available in the coming weeks, designed to provide a rapid snapshot of market performance over a specific period. The data presented in MWD are preliminary and subject to change when compared to the detailed report. The definitive data will be available in the final version of Market Watch. Therefore, any discrepancies between MWL and the comprehensive report should be noted

-Ends-

About Property Finder

A pioneering property portal in the Middle East and North Africa (MENA) region, Property Finder is on a mission to motivate and inspire consumers to get living the life they deserve. Connecting millions of property seekers with thousands of real estate professionals every day, Property Finder is a go-to place for a seamless and enriching house-hunting and finance-finding journey for both buyers and renters.

Since its inception in 2007, Property Finder has evolved into a trusted platform for developers, real estate brokers and property seekers to make informed decisions on all things real estate.

For more information, please contact:

Weber Shandwick

propertyfinder@webershandwick.com