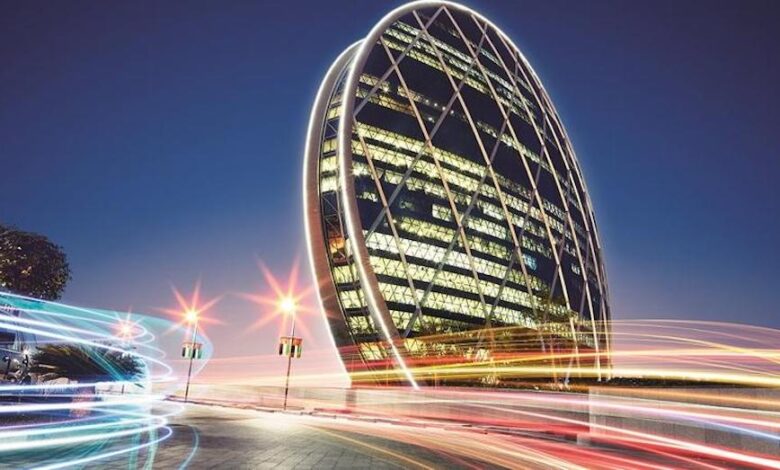

Abu Dhabi-based developer Aldar has reported a net profit increase of 57 per cent year-on-year (YoY) in H1 2024, driven by significant backlog realisation and robust performance of its investment portfolio.

The company achieved a revenue of Dhs10.9bn, up 73 per cent YoY, and earnings before interest, taxes, depreciation and amortisation (EBITDA) of Dhs3.9bn, a 61 per cent increase YoY. Net profit after tax reached Dhs3.3bn.

Mohamed Khalifa Al Mubarak, chairman of Aldar Properties, said: “The UAE real estate market continues to display solid fundamentals driven by strong end-user demand and increasing global investor interest, and this is reflected in Aldar’s strong financial and operational performance in the first six months of 2024. Underpinning this strength is the dynamism of the UAE economy. The UAE has become a premier destination for international corporations, entrepreneurs and capital through pro-growth policies and a business-friendly environment.

“Aldar is integral to the country’s development, providing exceptional lifestyle destinations and building the commercial and logistics infrastructure needed to cater to the growing demand. Leveraging its financial strength and technical expertise, Aldar is committed to remaining at the forefront of the UAE’s sustainable economic transformation and capitalising on the attractive market opportunities to drive long-term sustainable growth for our shareholders and stakeholders.”

Aldar Group H1 milestones

- Development sales in H1 2024 reached Dhs14bn, a 21 per cent YoY increase, driven by strong demand for new launches and existing inventory.

- Overseas and resident expat buyers contributed Dhs10.2bn, or 79 per cent, of UAE sales in H1.

- Development backlog hit Dhs39bn, with Dhs33.2bn in the UAE, ensuring revenue recognition over the next two to three years.

- Aldar plans to continue backlog realisation and launch new projects, supported by strategic land bank replenishment.

- Strategic entry into Dubai’s commercial segment with a commitment of Dhs1.8bn, including an office tower on Sheikh Zayed Road and the acquisition of ‘6 Falak’ in Dubai Internet City.

- High occupancy levels, particularly in the commercial portfolio, contributed significantly amid favourable market conditions.

- Partnership with DP World to develop a logistics park in Dubai, part of a Dhs1bn investment in logistics assets.

- Issuance of a second $500m green sukuk and buyback of 2025 sukuk, improving credit spread and extending debt maturity.

- Dhs3.6bn in free cash, Dhs7.6bn in undrawn credit facilities, and Dhs6.2bn in unrestricted escrow accounts.