Abu Dhabi state investor Mubadala and property developer Aldar Properties have deepened their partnership with the establishment of four joint ventures (JVs) that will own and manage assets worth more than Dhs30bn ($8.2bn) as part of the emirate’s broader strategy to boost its global appeal.

The deal seeks to unlock greater value for both parties and drive further transformation and growth of Abu Dhabi as a global business and lifestyle destination, the Abu Dhabi-backed entities said in a joint statement.

The ventures, which utilise Mubadala’s land bank and institutional expertise and Aldar’s strength in development and asset management, will be owned 60:40 by Aldar and Mubadala, respectively.

“This deal represents the continued evolution of our strategic partnership with Mubadala, with the latest collaboration designed to create substantial value for both parties by combining Aldar’s expertise in real estate asset management and development and Mubadala’s portfolio of high-quality income-generating assets and land bank,” said Talal Al Dhiyebi, group CEO of Aldar.

Aldar and Mubadala have set up four joint ventures, with one focused on combining ownership of a couple of premium shopping malls and another on acquiring residential and commercial assets in the district of Masdar City.

Through the partnership, Mubadala and Aldar will create a Dhs9bn retail platform that will own Abu Dhabi’s existing premier retail destinations.

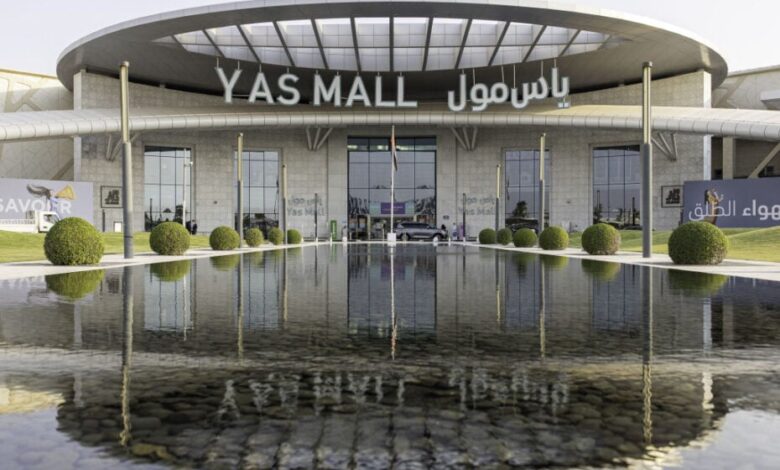

The new retail platform will include Aldar’s flagship retail destination, Yas Mall, while Mubadala will contribute The Galleria Luxury Collection, a luxury retail experience at Abu Dhabi Global Market.

Similarly, the partnership intends to establish a JV to own Dhs3bn worth of income-generating real estate assets in Masdar City, Abu Dhabi’s sustainable urban community and free zone hub.

The two other ventures are aimed at developing luxury real estate projects for two islands off the coast of Abu Dhabi for a combined gross development value of Dhs13bn and creating a logistics park close to Zayed International Airport.

Leveraging Mubadala’s prime land across Abu Dhabi, Aldar and Mubadala will create wellness-focused luxury waterfront communities on two undeveloped islands off the coasts of Saadiyat Island and Yas Island.

The two companies also seek to develop a Dhs5bn Grade A industrial logistics park in Al Falah with a gross floor area of 1.2 million square metres within a 2km radius of Zayed International Airport.

Abu Dhabi, home to three sovereign wealth funds, Abu Dhabi Investment Authority, Mubadala Investment Company and ADQ, is quickly becoming a hub for hedge funds, family offices, venture capital firms and crypto traders.

Earlier, Aldar said it would invest Dhs5bn to build new office, retail and hospitality facilities in the state by 2027.